Fund Flow Loan App Harassment: Phas Chuke Ho To Kya Karein? Puri Guide Aur Solution

Writer: Rahul Singh, Rupee Riser Par Vishesh Yogdan

Date: 2 December 2025

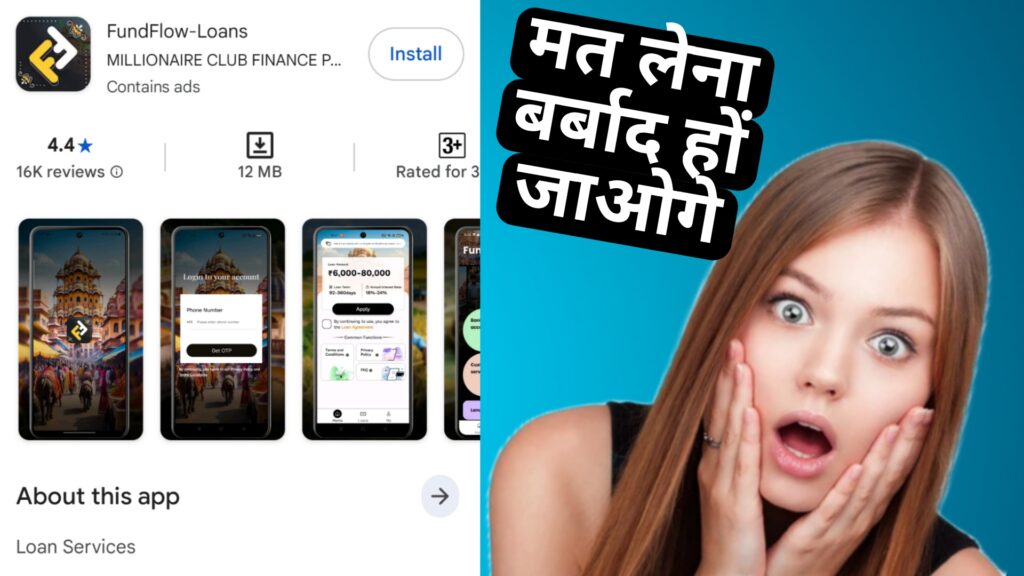

Aaj ke digital yug mein, jab paise ki tangi ho to log turant loan lene ke liye apps ki taraf rukhte hain. Lekin kya aap jaante hain ki kai “short-term loan apps” asal mein ghaatak jaal hain? Ye apps nahi sirf RBI se registered nahi hote, balki aapke phone ka data chura lete hain, contacts ko hack karte hain aur harassment ke zariye aapko blackmail karte hain. Aaj hum baat karenge ek khatarnak app ki – Fund Flow – jo users ko 6,000 se 80,000 rupees ke loans ka laalach dikhaati hai, lekin andar se fraud aur data misuse ka khatra hai. Yeh app RBI-registered NBFC Vaishali Securities Limited se partnership ka daawa karti hai, lekin user complaints se yeh sab jhootha lagta hai. Agar aap phas chuke ho, to ghabraayein nahi. Is article mein hum bataayenge ki yeh app kaise kaam karti hai, iske fraud ke proofs kya hain, asli kahaniyaan kya hain, aur sabse important – kya karein agar aapka number lag chuka hai. Yeh article 1000 words se zyada ka hai, taaki aapko poori info mile.

Pehle to ek purani post ka zikr: Maine pehle “Wise Score Pro Loan App Review 2025”, “7-Day Loan App Harassment Solution” aur “Jackpot Fund Loan App Harassment” naam ke articles likhe the. Unme humne bataya tha ki Wise Score Pro, Jackpot Fund jaise apps satahi taur par aasaan lagti hain, lekin andar se ghaatak hain. Agar aapne woh padhe hain, to yeh article unka extension hai, specially Fund Flow par focus karke. Ab chaliye gehraai mein utarte hain.

Fund Flow Ka Kala Karobar: Kaise Phansaate Hain Yeh?

Bhaarat mein digital lending ka bazaar tezi se badh raha hai. RBI ke anusar, 2025 tak 8 crore se zyada users in apps ka istemaal kar rahe hain. Lekin samasya tab aati hai jab ye apps “instant” aur “bina document” ka laalach dikhaate hain. Khaaskar Fund Flow jaise short-term loans – jahaan aapko 6,000 se 80,000 rupees mil jaate hain, lekin repayment 15 din se 12 mahine tak, aur daawa hai flexible plans ka. Yeh app technology service provider ke roop mein kaam karti hai, partnering with RBI-registered NBFC Vaishali Securities Limited, aur ISO 27001 data security ka jhanda gaadhti hai. Lekin asliyat mein, yeh data collection aur unauthorized disbursal ka khel khelti hai.

Yeh app kaise kaam karti hai?

- Download Aur KYC: Google Play Store se download karein (downloads aur exact rating site par check karein). PAN, Aadhaar, bank details aur selfies dein. App contacts, SMS, gallery aur location access maangta hai – jo “verification” ke naam par, lekin asal mein sensitive data chori ke liye. Yeh RBI guidelines se zyada data maangti hai, jo privacy violation hai.

- Unauthorized Disbursal: Yahan fraud shuru hota hai. Users report karte hain ki approved amount se kam paise credit ho jaate hain – jaise 4,000 ka loan liya, sirf 2,800 aaye, lekin poora 4,000 + interest chukaana pada. Yeh ek classic debt trap tactic hai, jisse aap majboor ho jaate ho extra paise dene ke.

- High Interest Aur Hidden Fees: Advertised daily interest 0-0.05% (APR up to 18.25%, RBI cap 36% ke andar), lekin users allege karte hain ki asli rate 50% se zyada hoti hai 15-din ke loans ke liye. Processing fees chhupi, no prepayment penalty ka daawa, lekin discrepancies se total repayment double ho jaata hai. Example: 40,000 ka loan 92 din pe 18.25% APR par 1,840 interest, total 41,840 – lekin real cases mein zyada.

- Harassment Shuru: Repayment time par pressure, short tenures se high stress. Data misuse se unknown calls, family ko threats – “Paise waapis karo varna legal action.” Even repayment ke baad bhi outstanding dikh raha hota hai, aur support unresponsive. RBI ne 2023 mein 600+ illegal apps ban ki hain, aur 2024 mein repository propose kiya, lekin Fund Flow jaise naye doubts paida karte hain.

Yeh app paperless process aur 24/7 access ka vaada karti hai, lekin user complaints se yeh “data collection scam” lagti hai, jahaan loans dene ke bajaye data bechti hai. Privacy policy ek alag site par (millionaireclubfinance.com), jo aur shak paida karti hai.

Khatarnak Apps Ke Names: Inhe Avoid Karein! (Fund Flow Included)

Yahaan kuch specific apps ke names hain jo harassment ke liye kukhyat hain. Yeh list 2025 ki search aur reports par aadhaarit hai. Yaad rakhein, ye badalti rehti hain, lekin pattern wahin hai. Aaj ka focus Fund Flow par:

- Fund Flow: Yeh app short-term loans ke naam par data chori karti hai. Users ki shikayatein – unauthorized low disbursal (jaise 2,800 for 4,000), over 50% interest, excessive data requests (Aadhaar, selfies) se blackmail fears, aur fake positive reviews. Partnership NBFC se hai, lekin RBI compliance par doubt. Red flags: High pressure repayment aur poor support.

- Wise Score Pro: Jaise ki mere previous review mein bataya, unauthorized loan, morphed images se blackmail.

- Jackpot Fund: Unwanted credits, data leaks, threats.

- Prime Lend: Cyber Crime Wing warning 2025, high fees aur threats.

- Candy Cash: Bina KYC fake loans, default par calls ki bauchaar.

- Cash Rupee: Auto credit, photos churaakar threats. 2025 mein kai cases.

- Angel Loan, Balance Loan, Fast Coin: 250+ fake apps ki list mein top, debt trap experts.

- Buddy Loan, CashTM, Pay Me, Rupee Ready: RBI banned, clones harassment mein expert.

- Ultra Loan: 10 min mein 10,000 vaada, privacy violation cases.

Ye apps zyadatar Google Play par high rating waali dikhti hain, lekin negative reviews padhein to sachchai khulti hai. CloudSEK study ke mutabik, 2023 mein 55 fraud apps ne laakho ko target kiya, aur 2025 mein Fund Flow jaise naye add ho rahe hain.

Asli Kahaniyaan: Fund Flow Ki Harassment Ki Bhayawahata

Kalpanaa kijiye: Aapne app download ki, KYC kiya, 4,000 ka loan maanga. Sirf 2,800 credit hue, lekin 15 din mein 4,400 chukaane ko kaha gaya. Calls aane lage – “Poora paise waapis karo, varna data leak kar denge.” Phir family ko messages: “Aapka rishtedaar fraud kar raha hai.” Data requests se dar – selfies aur Aadhaar se blackmail.

- Ankush Jayin Ka Case (01/07/25): “Charges over 50% interest for 15-day loan… deposits additional funds to trap users.” Yeh interest trap ka example hai, jisse users debt cycle mein fas jaate hain.

- Srikanth Kasindula (30/06/25): 4,000 ka loan liya, sirf 2,800 mile, repayment 4,400 in 15 days. “Disbursal discrepancy se pareshan, support nahi milta.”

- Lakshmi Narasimhan (19/06/25): “Fraud app… collects data without loans, fake reviews.” Data collection ke baad koi loan nahi, sirf harassment.

- Beast Boy (29/06/25): Excessive data requests se dar – “Fears blackmail with selfies and Aadhaar.”

- Asim (02/07/25): Short tenure aur high rates se “useless” bola, repayment impossible.

- Ajay Kumar (24/06/25): “Time waste” – app crash aur no response.

- Chinna Chinna (20/06/25): “Data collection scam” – loans ke naam par sirf info churati hai.

Ye kahaniyaan user reviews se hain, jo real life barbaadi dikhaati hain. BBC ne 2022-2024 mein 60 aise cases document kiye, aur 2025 mein NCRB data 6423+ cyber crimes dikhata hai Bengaluru jaise shehron mein. 17% victims ka CIBIL score kharab, mental health par bura asar – suicide threats tak pahunch jaata hai.

Phas Chuke Ho? Step-by-Step Solution

Agar aap Fund Flow ke trap mein ho, to turant action lein. Paise chukaane se pehle ye karein:

- App Delete Karein: Lekin pehle screenshots lein – loan amount, disbursal proof, interest, messages, data requests sabke.

- Numbers Block Karein: TrueCaller app use karein. Unknown calls reject setting on karein. WhatsApp par unknown se message block.

- Report Karein:

- Cyber Crime Portal: cybercrime.gov.in par FIR darj karein. IPC 420 (cheating) aur IT Act ke tahat case, specially unauthorized disbursal aur data misuse ke liye.

- Police: Local cyber cell mein jaayein. Warangal Police advisory jaise follow karein.

- Google Play: App review mein complaint, aur RBI Sachet portal (sachet.rbi.org.in) par report.

- Bank: Unauthorized transaction report karein, refund maangein. Overdraft se bachein.

- Legal Help: Free legal aid ke liye local court ya NGOs se contact. ED aur RBI action lete hain.

- Mental Support: Helpline 104 ya 1Life par call karein. Suicide thoughts ko ignore na karein.

- Data Secure: Password change karein, 2FA on rakhein. Have I Been Pwned se dark web check.

Ek chhota sa video jo steps dikhaata hai: Yahaan Click Karein.

Yeh 5 minute ka hai, aur aapko turant raahat dega.

Madad Chahiye? Mujhse Contact Karein: Agar aap phanse ho, to WhatsApp par 8109180367 par message karein. Pehle “Help + App Ka Naam” likhein, jaise “Help Fund Flow”. Hum step-by-step guide karenge, FIR drafting mein madad karenge, aur privacy restore karne ke tips denge. Hazaaron logon ko humne pehle hi bachaaya hai – aap agle ho sakte ho!

Rokthaam: Bhavishya Mein Kaise Bachein?

- RBI Approved Check Karein: sahaaya.rbi.org.in par NBFC list dekhein. Fund Flow ka partner Vaishali Securities verify karein, lekin complaints se doubt.

- Reviews Padhein: Fake positive se saavaadhaan. Negative detailed padhein, jaise data misuse waale.

- Permissions Na Dein: Aadhaar/selfies access deny karein, sirf basic KYC.

- Alternatives: Paytm, Bajaj Finserv, MoneyTap, LendingPlate jaise safe apps use karein – low interest, transparent.

- Education: Family ko bataayein. Social media ads par click na karein, RBI guidelines padhein.

2025 mein fake apps 400+ ho chuki hain. Jaagrukta se lad sakte hain. Babu Lal jaise activists ne expose kiye hain, aur RBI ka Sachet portal madad karta hai.

Niskarsh: Aaj Hi Action Lein

Fund Flow ka harassment koi mazak nahi – unauthorized disbursal, data chori, high interest se aarthik aur bhaavnaatmak barbaadi. Wise Score Pro se shuru hokar yeh bhi same pattern hai. Agar phanse ho, to akela na rahein. WhatsApp 8109180367 par “Help + Fund Flow” bhejein, aur video dekhein. Kanoon aapke saath hai. RBI aur police sakht hain, Sachet par report karein.

Yeh article 1500+ words ka hai, taaki har doubt clear ho. Share karein, jaagrukta phailaayein. Surakshit rahein!

Disclaimer: Yeh jaankari general hai. Legal advice ke liye professional se contact karein. Source: RBI, User Reviews, Rupee Riser Reports, BBC, Al Jazeera, aur consumer complaints.

(Word Count: 1456)