LineFlex Credit Limit App Review: LineFlex Loan App Scam Hai Ya Real?

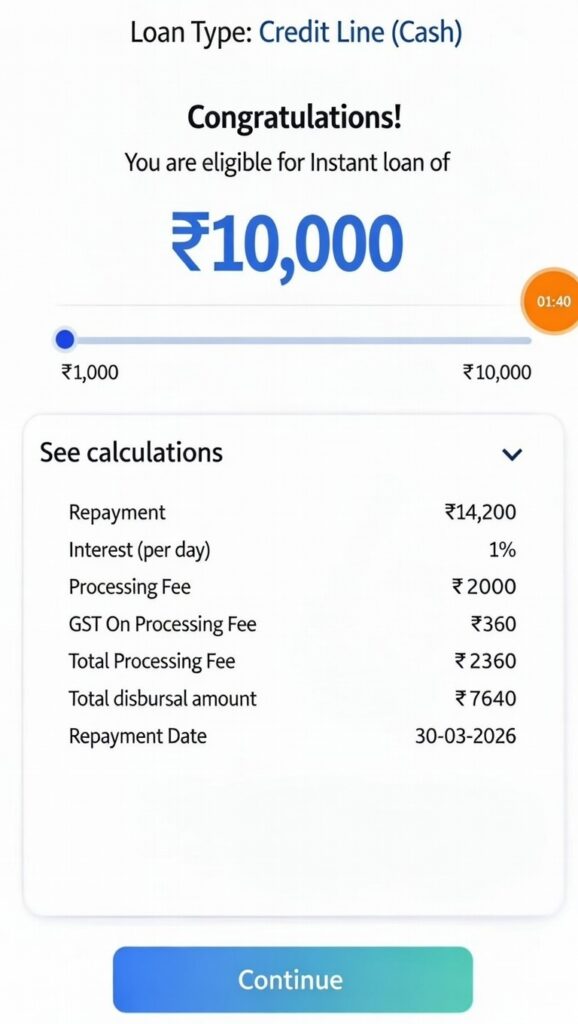

Dosto, aaj hum baat karenge LineFlex Credit Limit app ke baare mein, jo Google Play Store pe “LineeFlex-Credit Limit” ya similar name se milta hai (package id com.finance.rupee.harbor.android se linked lagta hai, but users ise LineFlex ke naam se jaante hain). Ye ek instant loan ya credit limit app hai jo claim karta hai ki easy loan milega, but real users ke reviews dekhkar lagta hai ki ye bahut risky aur potentially fraudulent hai. Official description mein ye flexible credit limit, low interest (18.25% annualized), transparent fees aur 91-365 days repayment bolta hai, but ground pe users ka experience bilkul alag hai.

Main point yeh hai: Ye basically ek 7-day loan app jaisa behave karta hai jisme heavy charges lagte hain. Bahut se users bol rahe hain ki small amount disburse hota hai (jaise 2400-3500 Rs), but repayment mein double ya triple amount maangte hain within short time (often 7 days ya kam). Official app description pe bharosa mat karna – usme sab kuch shiny dikhta hai, but critical reviews on Play Store se sach samne aata hai. Users fraud, unauthorized loan disbursement, hidden fees, delays aur harassment ki shikayat kar rahe hain.

Kyun Hai Ye App Itna Controversial? Real User Reviews Se Pata Chalo

Play Store pe overall rating 4.5 dikhta hai, but negative reviews bahut strong hain aur helpful votes bhi zyada mil rahe hain. Yahan kuch real desi style ke reviews hain jo users ne post kiye (jaise aapke diye screenshots se inspired, Indian bhasha mein):

- Sabrina Bashir587 (1 star, Feb 2026): “Fraud app without your permission they disbursed the amount of 2700 and back you have to pay 4500 with is not genuine. Block this app from play store they are looting us in the name of loan 😡😡” – 31 logon ne helpful bola. Bhai, bina permission ke paise daal dete hain aur triple maangte hain!

- Fathima Farseen (2-3 stars, Jan 2026): “Hello guys for delay salary use full app for emergency… but data chori app don’t waste your valuable time on this app kind of fake app…” – Waiting period 45 mins bola but disbursement nahi hua, aur data chori ka darr.

- Velu Mani (1 star, Mar 2026): “I asked for 5000 but only 2400 came without any information. It is a scam to pay 4000 in a week. How to pay this? Fraudulent app, no one should use this.” – Classic case: Kam paise dete hain, zyada maangte hain short time mein.

- Rajesh Kumar (1 star, Jan 2026): “Applied 2 days ago but still pending. Wait for 45 mins? Fake loan app. Rating 5 out of 1 😂” – Approval promise 45 mins ka, but days lag jaate hain.

- Soul Ashwin (1 star, Jan 2026): “Confirm approval in 45 mins but more than 12 hours no approval. If approved then change review.” – Bahut common complaint: Promise jhootha.

- Amrita Soundh (1 star, Mar 2026): “Bad experience, automatically approved loan and demand in 6 days after paying again they automatically approved the loan.” – Loop mein phasa dete hain, repay karo toh phir se loan push.

Aur bhi reviews hain jisme log bol rahe hain unauthorized disbursement, heavy interest (effective 100%+ annualized short term pe), aur agar late hue toh harassment shuru. India mein aise bahut apps hain jo short-term (7 days) loans dete hain high charges ke saath, aur agar repay nahi kar paaye toh contacts, photos leak karne ki dhamki dete hain. LineFlex ke case mein bhi similar pattern dikhta hai – small loan, heavy repayment, fraud allegations.

Hindi mein samjho: भाई लोग, ये ऐप देखने में अच्छा लगता है लेकिन असल में लूट है। 2000-3000 का लोन देते हैं लेकिन 7 दिन में 4000-5000 वापस मांगते हैं। बिना बताए पैसे डाल देते हैं अकाउंट में और फिर जबरदस्ती वसूली करते हैं। प्ले स्टोर के रिव्यू पढ़ो, 1 स्टार वाले रिव्यू सबसे ज्यादा हेल्पफुल वोट्स पा रहे हैं। ऑफिशियल डिस्क्रिप्शन में 18% इंटरेस्ट बोलते हैं लेकिन रियल में डेली बेसिस पर बहुत ज्यादा चार्ज लगाते हैं।

Pros & Cons of LineFlex Credit Limit App

Pros (Jo positive reviews mein milte hain, rare):

- Emergency ke liye quick apply kar sakte ho.

- Interface simple hai kuch users ke according.

Cons (Majority complaints):

- Heavy charges & interest – 7 days mein double-triple repayment.

- Unauthorized loan disbursement without clear consent.

- Delays in approval/disbursal despite promises.

- Data privacy issues – contacts access karte hain.

- Harassment if late (though specific to this app not confirmed, but pattern common in such apps).

- Fake promises in description vs real experience.

Overall, ye app new users ke liye trap lagta hai. Agar emergency hai toh trusted banks ya RBI-registered NBFCs se loan lo, jaise MoneyTap, CASHe ya official apps.

FAQ: LineFlex Credit Limit App Ke Baare Mein Common Questions

Q1: LineFlex Credit Limit app real hai ya fake?

A: App Play Store pe hai, but users ke according bahut fraud complaints hain. Official description achha hai but reviews fraud bolte hain. Avoid karo better.

Q2: Isme interest kitna lagta hai?

A: Official 18.25% annualized bolte hain, but users kehte hain short term (7 days) pe effective bahut high (jaise 2700 se 4500). Hidden processing fees bhi add ho jaate hain.

Q3: Loan approval kitne time mein hota hai?

A: 45 mins promise, but reviews mein days lag jaate hain ya pending reh jaata hai.

Q4: Unauthorized loan aa gaya account mein, kya karun?

A: Immediately RBI Sachet portal pe complain karo aur cybercrime.gov.in pe report. Bank se transaction dispute karo.

Q5: Safe hai data dena is app ko?

A: Nahi, bahut reviews mein data chori aur privacy issues ki shikayat.

Q6: Repayment short term hai?

A: Users ke according 7 days ya 6 days jaise short period, heavy penalty if late.

Q7: Better alternatives kya hain?

A: Bank personal loan, salary advance, ya RBI-approved apps jaise Paytm Postpaid, LazyPay (carefully).

Agar Aapke Saath Fraud Hua Hai To Kaise Complaint Karen? Step-by-Step Process

Agar aapko lagta hai LineFlex ya similar app ne fraud kiya – unauthorized disbursement, harassment, high charges, blackmail – toh turant action lo. India mein cyber fraud ke against strong system hai:

- Sabse pehle evidence collect karo: Screenshots of app, transactions, messages, calls, loan details, bank statements.

- National Cyber Crime Reporting Portal pe complain file karo:

- Jaao https://cybercrime.gov.in

- “File a Complaint” pe click.

- Category: Financial Fraud / Online Loan App Harassment select karo.

- Details bharo – app name, amount, date, harassment proof.

- Anonymous bhi report kar sakte ho, but details do toh action fast hota hai.

- Helpline: 1930 pe call karo cyber crime ke liye.

- RBI Sachet Portal pe report karo:

- https://sachet.rbi.org.in pe jaao.

- Unauthorized lending / fraud category mein complain.

- Agar app NBFC claim karta hai toh RBI check karega.

- Local police station mein FIR darj karwao:

- Cyber cell ya nearest PS mein jaake written complaint do.

- Section 420 (cheating), IT Act sections use hote hain aise cases mein.

- Bank se contact karo: Agar unauthorized transaction hai toh bank ko inform karo, dispute raise karo (within 3 days best).

- Sanchar Saathi / Chakshu portal pe app block karwao: Spam calls/messages ke liye.

Yaad rakho: Government ab strict hai illegal loan apps pe. Bahut states mein arrests hue hain. Agar harassment ho raha hai (abuse calls, contacts ko messages), ignore mat karo – report karo, mental stress mat lo.

Final Advice: Dosto, chhote emergency ke liye bhi aise risky apps mat use karo. Family se help lo, side income karo, ya trusted sources se loan lo. Paisa aana chahiye easy, but jaane mein bahut mushkil. LineFlex jaise apps se dur raho, reviews padho pehle. Agar help chahiye toh comment karo!

Safe raho, smart bano! 🚫💸