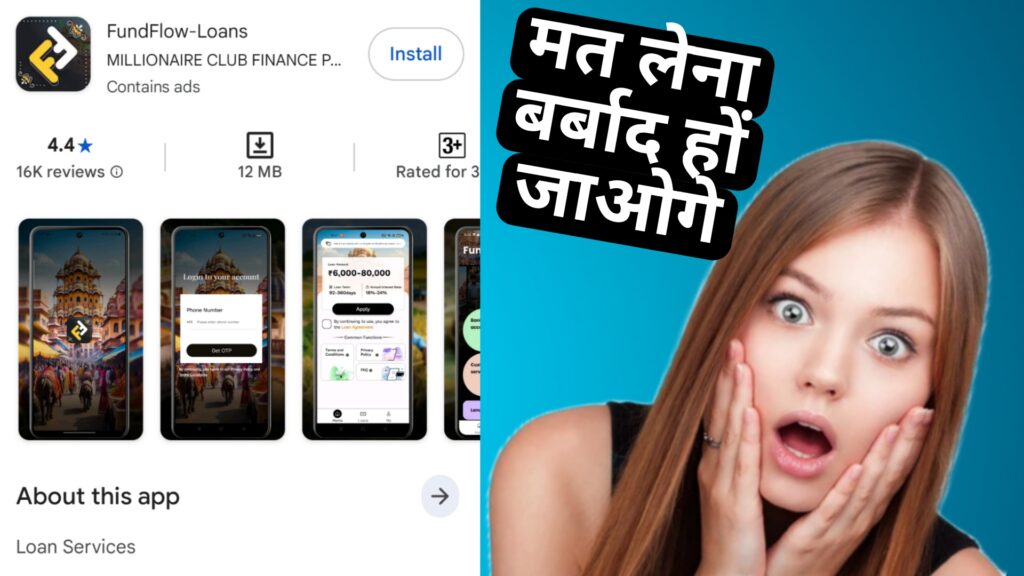

Fund Flow Loan App Review: Features, Concerns, and RBI Compliance

In the fast-paced world of digital lending, Fund Flow has emerged as a loan app promising quick, short-term loans for urgent financial needs. Offering loans for as little as 15 days, Fund Flow markets itself as a convenient, RBI-compliant platform connecting users with regulated Non-Banking Financial Companies (NBFCs) like VAISHALI SECURITIES LIMITED. However, customer reviews paint a troubling picture, raising serious questions about its transparency, interest rates, and data security practices. This article provides an in-depth, SEO-optimized analysis of Fund Flow, exposing its operations, customer feedback, and compliance status, while addressing critical concerns to help you make an informed decision.

What is Fund Flow Loan App?

Fund Flow is a digital lending platform that facilitates short-term loans ranging from ₹6,000 to ₹80,000, with repayment tenures as short as 15 days to 12 months. It operates as a technology service provider, connecting eligible borrowers with RBI-registered NBFCs. The app emphasizes a seamless, paperless process, claiming full compliance with Reserve Bank of India (RBI) guidelines, including DNBR.PD.007/03.10.119/2016-17. Its key selling points include a transparent cost structure, no prepayment penalties, and adherence to data security standards like ISO 27001.

Key Features of Fund Flow

- Loan Amount: ₹6,000 to ₹80,000 for urgent financial needs.

- Interest Rates: Daily interest rate of 0-0.05% (Annual Percentage Rate or APR up to 18.25%, capped at 36% per RBI guidelines).

- Repayment Tenure: Flexible plans from 3 to 12 months, with 15-day loans as a highlighted option.

- No Hidden Fees: Claims no processing fees or prepayment penalties.

- Digital Process: 24/7 application access via a secure mobile platform.

- Regulatory Compliance: Loans issued through RBI-registered NBFCs like VAISHALI SECURITIES LIMITED.

- Data Security: Adheres to ISO 27001 standards with end-to-end encryption.

Example Loan Calculation

For a ₹40,000 loan with an APR of 18.25% over 92 days:

- Interest Payable: ₹1,840

- Total Repayment: ₹41,840

Note: Actual terms depend on credit evaluation.

Customer Reviews: A Cause for Concern

While Fund Flow promotes itself as a legitimate and user-friendly app, customer reviews tell a different story. Many users have flagged the app as potentially fraudulent, citing exorbitant interest rates, unauthorized data collection, and poor customer service. Below is a summary of the alarming feedback from users:

- High Interest Rates: Ankush Jayin (01/07/25) claimed Fund Flow charges over 50% interest for a 15-day loan, far exceeding the advertised APR of 18.25%. He also alleged that the app deposits additional funds into users’ accounts to trap them into paying more.

- Short Tenure Issues: As Asim (02/07/25) criticized the app’s short 15-day tenure and high interest rates, calling it “useless” and advising against its use.

- Data Privacy Concerns: Beast Boy (29/06/25) raised red flags about the app requesting sensitive information like Aadhaar, bank details, and selfies before confirming loan eligibility, expressing fears of potential blackmail.

- Fraud Allegations: Lakshmi Narasimhan (19/06/25) labeled Fund Flow a “fraud” app, accusing it of collecting data without sanctioning loans and providing ineffective customer support. He suggested positive reviews might be fake.

- Discrepancies in Loan Disbursement: Srikanth Kasindula (30/06/25) reported that for a ₹4,000 loan, only ₹2,800 was credited, but the repayment demanded was ₹4,400 within 15 days, indicating deceptive practices.

- Time-Wasting and Data Collection: Ajay Kumar (24/06/25) and Chinna Chinna (20/06/25) called the app a “time waste” and a “data collection scam,” urging users to avoid it.

These reviews suggest a pattern of predatory practices, including inflated interest rates, unauthorized data access, and discrepancies between promised and actual loan terms.

Is Fund Flow RBI-Compliant?

Fund Flow claims to operate under RBI guidelines through partnerships with registered NBFCs like VAISHALI SECURITIES LIMITED. The RBI’s digital lending guidelines (DNBR.PD.007/03.10.119/2016-17) mandate transparency in interest rates, clear loan agreements, and strict data privacy protocols. While Fund Flow’s website highlights compliance with these standards, customer complaints about excessive interest rates and data misuse raise doubts about its adherence to RBI regulations.

The RBI has cracked down on illegal loan apps, banning over 600 such platforms in 2023 alone. It also proposed a public repository of authorized digital lending apps in August 2024 to help consumers identify legitimate platforms. To verify Fund Flow’s legitimacy, check the RBI’s official website for NBFC registration details or use the Sachet portal (https://sachet.rbi.org.in) to report suspicious activities.

Data Security: Safe or Risky?

Fund Flow claims to follow ISO 27001 standards with end-to-end encryption to protect user data. Its privacy policy is accessible at [https://www.millionaireclubfinance.com/ourprivacypolicymill.html]. However, user reviews like those from Beast Boy and Lakshmi Narasimhan highlight concerns about excessive data collection, including Aadhaar details, bank account information, and selfies, before loan approval. Such practices could violate RBI guidelines, which restrict apps from accessing unnecessary data like contacts or photos.

Red Flags to Watch Out For

Based on customer feedback and RBI guidelines, here are warning signs to consider before using Fund Flow:

- High Interest Rates: Complaints of rates exceeding 50% for 15-day loans contradict the advertised 18.25% APR.

- Data Misuse: Requests for sensitive information before eligibility confirmation raise privacy concerns.

- Discrepancies in Loan Amounts: Users report receiving less than the approved amount but being asked to repay more.

- Poor Customer Service: Multiple reviews mention unresponsive or unhelpful support.

- Potential Fraud: Allegations of unsolicited fund deposits to inflate repayment obligations suggest predatory tactics.

How to Protect Yourself

To avoid falling victim to fraudulent loan apps like those described in reviews, follow these steps:

- Verify RBI Registration: Check if the app’s NBFC partner is listed on the RBI website.

- Read Reviews: Look for consistent negative feedback on platforms like Google Play Store or Apple App Store.

- Check App Permissions: Avoid apps requesting access to contacts, photos, or messages beyond KYC requirements.

- Demand Transparency: Ensure the app provides a clear loan agreement with interest rates and repayment terms.

- Report Fraud: Use the RBI’s Sachet portal or the National Cyber Crime Reporting Portal (cybercrime.gov.in) to report suspicious apps.

Conclusion: Should You Use Fund Flow?

While Fund Flow markets itself as a convenient, RBI-compliant loan app, customer reviews expose serious issues, including high interest rates, potential data misuse, and fraudulent practices. These allegations contradict the app’s claims of transparency and regulatory adherence, making it a risky choice for borrowers. Until Fund Flow addresses these concerns and provides verifiable proof of compliance, it’s wise to approach with caution. Always prioritize RBI-approved apps like Paytm, Bajaj Finserv, or MoneyTap, which have established reputations for transparency and security.

For a safe borrowing experience, verify the app’s credentials, read user reviews, and never share sensitive information without confirming legitimacy. If you suspect fraud, report it immediately to the RBI or cybercrime authorities.

FAQs About Fund Flow Loan App

1. Is Fund Flow a legitimate loan app?

Fund Flow claims to partner with RBI-registered NBFCs like VAISHALI SECURITIES LIMITEDLion LIMITED. However, customer reviews alleging high interest rates, data misuse, and fraud raise concerns about its legitimacy. Verify the NBFC’s registration on the RBI website before proceeding.

2. What are the interest rates charged by Fund Flow?

The app advertises a daily interest rate of 0-0.05% (APR up to 18.25%), but users report rates exceeding 50% for 15-day loans, which may violate RBI guidelines.

3. Is my data safe with Fund Flow?

Fund Flow claims to follow ISO 27001 standards with end-to-end encryption. However, users have reported excessive data collection, including Aadhaar and bank details, before loan approval, raising privacy concerns.

4. What is the loan amount and tenure offered by Fund Flow?

Fund Flow offers loans from ₹6,000 to ₹80,000 with tenures ranging from 15 days to 12 months.

5. How can I report fraudulent practices by Fund Flow?

You can file a complaint via the RBI’s Sachet portal (https://sachet.rbi.org.in) or the National Cyber Crime Reporting Portal (cybercrime.gov.in).

6. Are there safer alternatives to Fund Flow?

Yes, RBI-approved apps like Paytm, Bajaj Finserv, MoneyTap, and LendingPlate offer transparent and secure lending services with better user reviews.