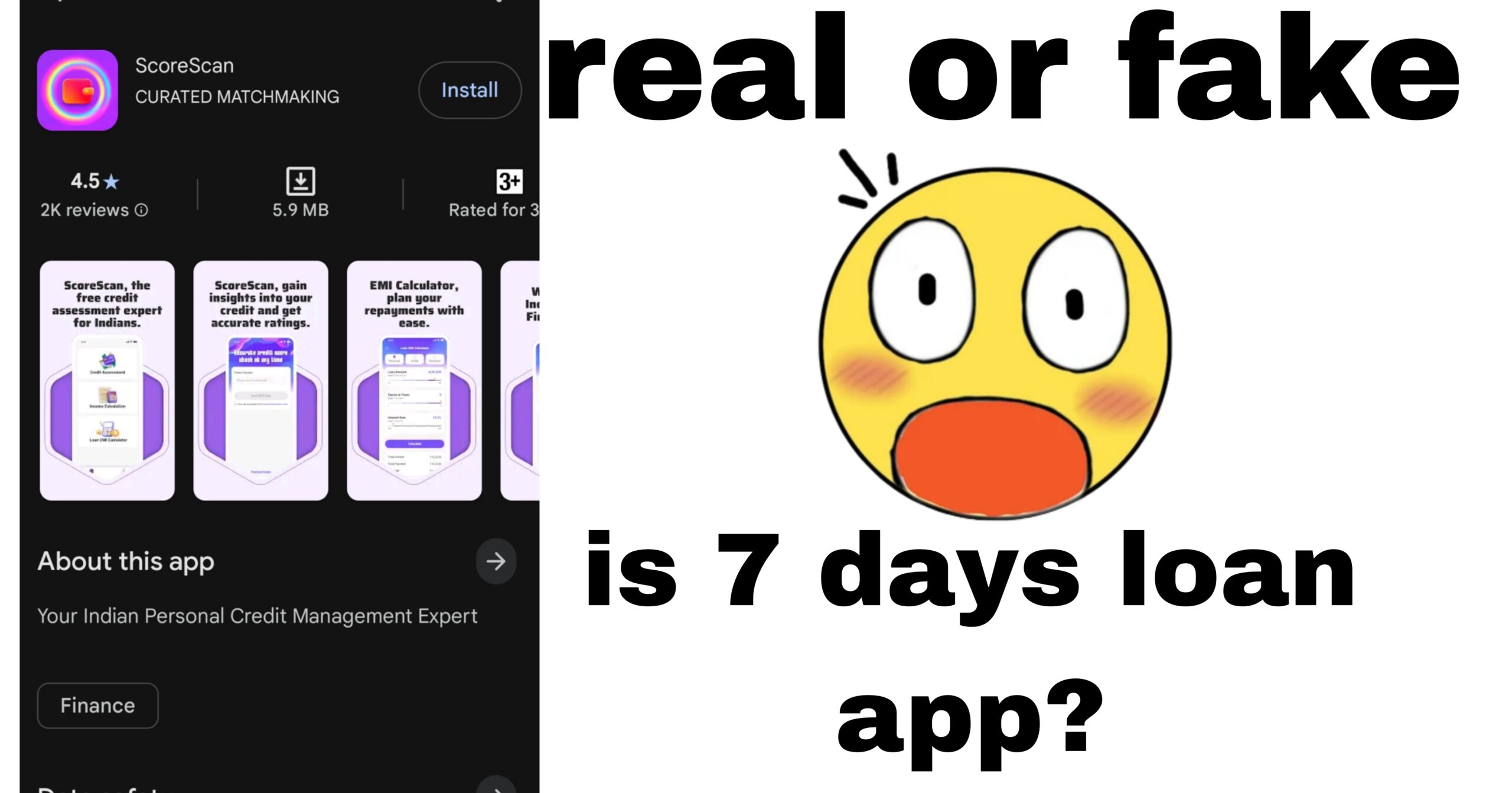

Exposing ScoreScan Loan App: Is It Real or a Fraudulent Trap?

In the rapidly growing digital lending space in India, loan apps have become a go-to solution for individuals seeking quick financial assistance. However, this convenience has also given rise to a surge in fraudulent apps that exploit vulnerable borrowers with promises of easy loans and credit score improvement. One such app that has recently come under scrutiny is ScoreScan, which markets itself as a “Personal Credit Management Expert” for Indian users. This article aims to expose the truth behind ScoreScan, analyzing whether it is a legitimate platform or a deceptive scam based on user reviews, reported practices, and its operational model. With a focus on its high charges, short repayment periods, and questionable claims of credit score improvement, we will uncover the reality behind this app.

What is ScoreScan?

ScoreScan presents itself as a free credit score query and financial management app tailored for Indian users. According to its promotional material, it offers a range of features to help users manage their finances effectively, including:

- Free Credit Score Query: Real-time access to credit scores from major Indian credit bureaus like CIBIL and Equifax.

- Income Assessment Tool: Estimates income range based on credit history and career data.

- EMI Installment Calculator: Allows users to calculate EMIs for various loans, such as home, car, and personal loans, with customizable interest rates and repayment terms.

The app claims to require no paid subscription, offering “one-click access to professional credit scores” and tools to make financial decisions transparent and efficient. Its office is listed at #35 S.R.T Road, Shivaji Nagar, Bangalore, Karnataka, 560051, India, with a customer service email: help@matchmakingprivate.com. However, user reviews and reported experiences paint a starkly different picture, raising serious concerns about its legitimacy and operations.

Red Flags: User Reviews and Complaints

To evaluate ScoreScan’s credibility, we turn to user reviews, which provide firsthand insights into the app’s practices. The feedback from users, dated as recently as July 2025, reveals a pattern of deceptive tactics, high charges, and poor customer service. Here are some key complaints:

- High Processing Fees and Hidden Charges:

- Users consistently report exorbitant processing fees and hidden charges. For instance, Swamy Siva mentioned receiving only ₹1,800 out of a ₹3,000 loan, with ₹1,200 deducted as processing fees for a mere 7-day loan period. Similarly, Vinoth Kannan noted that for a ₹5,000 loan, only ₹3,000 was disbursed, with ₹2,000 taken as processing fees, and the full ₹5,000 had to be repaid within 6 days.

- Priyanka Pathak highlighted a case where a ₹15,000 loan limit was shown, but only ₹9,000 was disbursed, with ₹6,000 charged as interest for a 7-day repayment period. Such practices indicate that ScoreScan imposes predatory fees, significantly reducing the actual loan amount received by borrowers.

- Short Repayment Periods:

- The app operates on a 6- to 7-day repayment cycle, which is unusually short for personal loans. Legitimate lenders typically offer repayment terms ranging from months to years, allowing borrowers to manage repayments comfortably. A 7-day repayment period, combined with high charges, places immense financial pressure on users, often leading to debt traps.

- Unsolicited Loans and Blackmail:

- Saneesh’s review warns that ScoreScan automatically grants loans without user consent after collecting sensitive information like KYC documents and selfies. Once the loan is disbursed, users are given just 7 days to repay, and failure to do so results in threats of blackmail, including misuse of personal photos. This unethical practice is a hallmark of fraudulent loan apps.

- Lack of Customer Support:

- Multiple users, including Priyanka Pathak and Vinoth Kannan, reported the absence of functional customer support. The app lacks a contact number, and complaints sent via email (to help@matchmakingprivate.com) go unanswered. Even after repaying loans, users noted that the app continued to show outstanding dues, further harassing borrowers.

- Inability to Delete Accounts:

- Saneesh mentioned being unable to delete their account, raising concerns about data privacy. Fraudulent apps often collect sensitive information (such as Aadhaar, PAN, and bank details) under the guise of loan processing, which may be misused for identity theft or sold on the dark web.

- Fake Credit Score Improvement Claims:

- ScoreScan markets itself as a tool to improve credit scores, but user reviews do not corroborate this claim. Instead, the app appears to use the promise of credit score enhancement as bait to lure users into applying for loans, only to trap them with high fees and short repayment terms. There is no evidence that ScoreScan provides legitimate credit score improvement services.

Is ScoreScan Legitimate or a Scam?

To determine whether ScoreScan is real or fake, we must compare its practices against the characteristics of legitimate and fraudulent loan apps, as outlined by regulatory guidelines and industry standards.

Characteristics of Legitimate Loan Apps

- RBI Registration: Legitimate loan apps in India are either operated by or partnered with Reserve Bank of India (RBI)-registered Non-Banking Financial Companies (NBFCs) or banks. They adhere to RBI guidelines, including transparent disclosure of interest rates, fees, and repayment terms.

- Transparent Terms: Authentic lenders provide a detailed loan agreement, including a Key Fact Statement (KFS), outlining all charges and terms before disbursal.

- Reasonable Fees: Processing fees are deducted from the loan amount after approval, not upfront, and are typically a small percentage of the loan.

- Customer Support: Legitimate apps offer clear contact details, including phone numbers, email addresses, and physical office addresses, with responsive customer service.

- Data Privacy: They use advanced encryption to protect user data and allow users to delete accounts or revoke permissions.

ScoreScan’s Practices: A Fraudulent Pattern

ScoreScan exhibits several red flags commonly associated with fake loan apps:

- Unverified RBI Registration: There is no evidence in the provided information or user reviews confirming that ScoreScan is registered with the RBI or partnered with an RBI-approved NBFC. The RBI’s official website lists registered lenders, and users should verify this before engaging with any loan app. ScoreScan’s failure to provide such credentials is a major concern.

- Exorbitant Charges: Deducting 40-50% of the loan amount as processing fees (e.g., ₹1,200 on a ₹3,000 loan or ₹6,000 on a ₹15,000 loan) is predatory and violates RBI guidelines, which cap interest rates and fees to protect borrowers.

- Lack of Transparency: Users report unclear terms and conditions, with no proper loan agreement provided. This contradicts RBI mandates requiring lenders to issue a KFS.

- Unsolicited Loans: Disbursing loans without consent is an unethical practice used by fraudulent apps to trap users into repayment cycles.

- Harassment and Blackmail: Threats to misuse personal data, such as photos, align with tactics used by rogue apps to coerce repayments.

- Suspicious Contact Details: The customer service email (help@matchmakingprivate.com) is unrelated to financial services, raising doubts about the app’s legitimacy. The listed office address in Bangalore has not been verified, and the lack of a contact number further erodes trust.

- Poor Reviews: Consistent negative feedback across platforms highlights issues like high fees, harassment, and non-functional customer support, a common trait of fake loan apps.

Based on these points, ScoreScan aligns closely with the characteristics of fraudulent loan apps, as outlined by sources like the RBI and consumer protection blogs. Its claims of being a “credit management expert” appear to be a facade to collect sensitive user data and impose exploitative loan terms.

The Dangers of Using ScoreScan

Engaging with ScoreScan poses several risks, as evidenced by user experiences and industry warnings:

- Financial Loss: High processing fees and interest rates result in borrowers receiving significantly less than the approved loan amount while being required to repay the full amount in a short period.

- Data Theft: The app’s collection of KYC documents, selfies, and other personal information without proper safeguards raises concerns about identity theft or data misuse.

- Credit Score Damage: Unsolicited loans or fraudulent transactions reported by ScoreScan could negatively impact users’ credit scores, as noted in sources like Airtel’s guide on fake loan apps.

- Harassment: Threats of blackmail and relentless repayment demands, as reported by users, can cause emotional distress and social stigma.

- Legal Complications: Recovering funds or resolving disputes with an unregistered lender is challenging, as users lack access to RBI’s grievance redressal mechanisms.

How to Protect Yourself from Apps Like ScoreScan

To avoid falling victim to fraudulent loan apps like ScoreScan, follow these steps recommended by experts and regulatory bodies:

- Verify RBI Registration: Check the RBI’s official website for a list of registered NBFCs and banks. Avoid apps that cannot provide proof of registration.

- Read Reviews Carefully: Look for consistent negative feedback on app stores or consumer forums. Be wary of apps with suspiciously high ratings, as they may use fake reviews.

- Demand Transparency: Insist on a detailed loan agreement and KFS before accepting any loan. Avoid apps that hide fees or terms.

- Avoid Upfront Fees: Legitimate lenders deduct fees from the loan amount after disbursal, not before.

- Protect Personal Data: Limit permissions granted to apps and avoid sharing sensitive information like OTPs, Aadhaar, or PAN details unless the lender is verified.

- Report Fraud: If you encounter a suspicious app, report it to the National Cyber Crime Reporting Portal (1930 or www.cybercrime.gov.in), the RBI, or the app store.

- Monitor Your Credit Report: Regularly check your credit score through trusted platforms like CIBIL or Equifax to detect unauthorized loans or inquiries.

What to Do If You’ve Used ScoreScan

If you’ve already engaged with ScoreScan and suspect foul play, take immediate action:

- Gather Evidence: Save screenshots, emails, transaction records, and any communication with the app.

- File a Complaint: Report the app to the National Cyber Crime Reporting Portal, your local police, or the RBI.

- Notify Your Bank: Inform your bank to block unauthorized transactions and secure your account.

- Check Your Credit Report: Request a free credit report from CIBIL, Equifax, or Experian to identify any fraudulent loans or inquiries.

- Consult a Legal Expert: Seek legal advice to address data misuse or recover funds.

Conclusion

ScoreScan, despite its claims of being a “Personal Credit Management Expert,” exhibits multiple characteristics of a fraudulent loan app. Its high processing fees, short repayment periods, unsolicited loan disbursals, lack of customer support, and questionable data practices align with tactics used by rogue lenders to exploit vulnerable borrowers. User reviews from July 2025 highlight severe financial losses, harassment, and data privacy concerns, reinforcing the app’s deceptive nature. The absence of verifiable RBI registration and transparent terms further cements its status as a potential scam.

Know about :waterfall loan app

In a digital lending landscape fraught with risks, borrowers must exercise extreme caution. Stick to RBI-approved loan apps like KreditBee, PaySense, or IndiaLends, which offer transparent terms and adhere to regulatory guidelines. By verifying lenders, reading reviews, and protecting personal data, you can avoid falling into traps like ScoreScan. Stay informed, stay vigilant, and prioritize your financial security.

Disclaimer: The information in this article is based on user reviews and general characteristics of fraudulent loan apps. Always verify lender credentials with official sources like the RBI before engaging with any loan app.