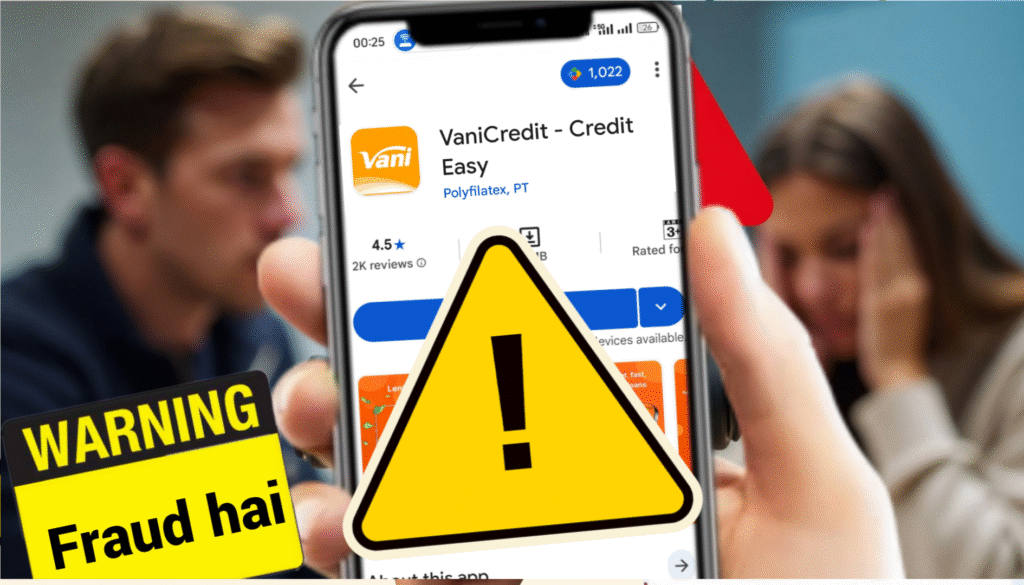

VaniCredit – Credit Easy Loan App Review: VaniCredit Loan Real Ya Fake?

Aaj kal instant loan apps bahut popular ho gaye hain India mein, especially jab emergency cash ki zarurat padti hai. Ek aisa hi app hai VaniCredit – Credit Easy, jo Play Store pe available hai (package id: com.polyfilatex.vani). Ye app claim karta hai ki ye aapke credit ko manage karne mein help karega, budget track karega, aur smart financial decisions lene mein madad dega. Lekin asli picture bahut alag hai! Bahut se users isko fraud app bol rahe hain, high interest charges, unauthorized loan disbursement, aur harassment ki shikayatein aa rahi hain.

Is article mein hum detail se baat karenge VaniCredit app ke bare mein, uske claims vs reality, Play Store ke critical reviews pe focus karte hue, kyunki app description pe bharosa nahi karna chahiye. Ye ek typical 7-day short term loan app jaisa behave kar raha hai, jisme heavy charges lagte hain aur repayment double ya zyada maangte hain. Hum FAQ bhi add kar rahe hain aur last mein bataenge ki agar aapke saath fraud hua to kaise complaint karen. Ye article 1200+ words ka hai taaki aapko complete information mile aur aap safe rahein.

VaniCredit App Kya Hai? Official Claims

Play Store pe app ka description dekhen to ye ek credit management tool lagta hai. Ye kehta hai:

- Credit status monitor karo

- Budget track karo (income-expense)

- User-friendly interface

- Data security with encryption

- Loan preparation ya credit history improve karne mein help

Lekin interest rates, loan amount, tenure jaise details nahi diye gaye hain clearly. Downloads 50K+ hain, updated Jan 2026 mein hua. Developer Polyfilatex, PT hai. Overall rating shayad high dikhta hai kuch fake positive reviews se, lekin critical reviews bilkul opposite hain.

Real mein ye app instant personal loan deta hai small amounts (jaise 1800-3000 rupees) short tenure (7-10 days) ke liye, lekin hidden heavy charges ke saath. Ye typical 7-day loan apps ki category mein aata hai jo bahut high interest (sometimes 200-300% effective) charge karte hain.

Critical Reviews from Play Store: Users Ki Real Kahani

App description pe bharosa mat karo – Play Store ke real user reviews dekho, especially negative ones jo bahut helpful votes pa rahe hain. February 2026 ke reviews se clear pattern dikhta hai fraud ka:

- Sonu Kumar (1 star, 13/02/26): “I was looking for 5000 rupees loan, but without consent 3000 rupees deposit via different UPI IDs. Now demanding double amount. This is fake and fraud app. Small amount for 7-10 days, double maangte hain. Beware, don’t download!”

44 logon ne helpful bola. - Sadhna Singh (1 star, 13/02/26): “Fraud app… Applied for loan, shows 3000 credit but not happen, sent 1800 in wallet not to account. They take your info and start torching you. Don’t install!”

22 helpful votes. - Praveen Naidu (1 star, 12/02/26): “Worst experience, didn’t take loan but app shows previous loan pending. No loan tha phir bhi pay karna bol raha.”

19 helpful. - Kiran Kumar (1 star, 13/02/26): “Don’t apply! Took 3000, then showing interest 2000. Fraud app, too much interest.”

13 helpful. - Manoj Kumar Bendi (1 star, 15/02/26): “Complaint to RBI, Central Home Ministry, Finance Ministry for misusing privacy data. Without info deposit hota hai high interest ke saath.”

- Fajis Ubaid (1 star, 14/02/26): “Totally fraud. Received 1800, want to pay 3000 more in 7 days. Don’t take money.”

- Prasad Rekapalli (1 star, 12/02/26): “Fraud app, don’t install, data fraud. Completely don’t trust!” (Bahut saare angry emojis ke saath).

Positive review bhi hai jaise Parth Rathod (5 star): “Good app, fast approval and transfer.” Lekin ye sirf 9 helpful votes, aur negative reviews 10-40+ helpful pa rahe hain. Clear hai ki majority users fraud bol rahe hain.

Ye pattern common hai fake loan apps mein: Small amount disburse karo (sometimes partial ya wallet mein), phir repayment double maango with threats, contacts harass karo.

Kyun Ye App Heavy Charges Karta Hai? 7-Day Loan Trap

VaniCredit jaise apps short-term loans dete hain 7 days ke liye. Example:

- Apply 5000 ke liye → Sirf 1800-3000 disburse

- Repayment: Principal + high interest (sometimes 100-200% in week)

- Total: 3000 liye 5000-6000+ maangte

Ye predatory lending hai, jisme borrowers trap ho jaate hain. RBI guidelines ke according registered NBFC hona chahiye, fair interest, no harassment. Lekin in apps mein privacy data misuse, unauthorized transfers, aur recovery mein threats common hain.

2026 mein bhi bahut fake loan apps chal rahe hain despite RBI actions. VaniCredit specifically Play Store reviews mein fraud flag ho raha hai.

VaniCredit App Ke Risks Aur Red Flags

- Unauthorized disbursements without full consent

- High hidden charges aur double repayment demands

- Data misuse – Contacts access karke harass

- Fake positive ratings possible (kuch reviews suspicious)

- No clear RBI registration mention in description

- Harassment – Calls, messages torching

Agar aap short term loan le rahe ho to genuine apps choose karo jaise Bajaj Finserv, MoneyTap, ya RBI-registered NBFCs.

FAQ: VaniCredit App Ke Bare Mein Common Questions

Q1: VaniCredit app real hai ya fake?

A: App Play Store pe hai, lekin users ke according fraud hai. Small loan dekar double maangte hain, harassment karte hain. Critical reviews pe trust karo.

Q2: Ye kitna interest charge karta hai?

A: Official nahi batate, lekin users bol rahe 2000+ interest 3000 loan pe 7 days mein. Bahut heavy!

Q3: Kya ye 7-day loan app hai?

A: Haan, short tenure (7-10 days) ke loans, high charges ke saath.

Q4: Safe hai download karna?

A: Nahi! Bahut se users warn kar rahe hain don’t install, data fraud aur harassment.

Q5: Positive reviews kyun hain?

A: Kuch genuine ho sakte, lekin zyadatar negative critical hain. Fake positives bhi possible.

Q6: Loan approve hone ke baad kya hota hai?

A: Partial amount disburse, phir full repayment + extra maangte, threats dete.

Q7: Data privacy ka kya?

A: Users bol rahe contacts access karke harass, privacy misuse.

Agar Aapke Saath Fraud Hua To Kaise Complaint Karen?

Agar VaniCredit ya similar app ne fraud kiya (unauthorized deposit, harassment, data misuse), turant ye steps lo:

- App uninstall karo, all permissions revoke (Settings > Apps > Permissions).

- Payments stop karo – Agar possible, bank se block karo UPI/transactions.

- Cyber Crime Report karo: National Cyber Crime Reporting Portal pe jaao – https://cybercrime.gov.in/ ya call 1930. Details do app ka, screenshots, messages.

- RBI Complaint: RBI ke CMS portal pe – https://cms.rbi.org.in/ ya Sachet portal https://sachet.rbi.org.in/complaints/add. Digital lending fraud select karo.

- Police Complaint: Local police station ya cyber cell mein FIR file karo, especially agar threats aa rahe.

- Ministry complaints: Home Ministry ya Finance Ministry ke portals pe bhi report kar sakte.

- Google Play Report: App page pe report karo as inappropriate/fraud.

- Evidence save karo: Screenshots of app, transactions, messages, calls.

Jaldi action lo, kyuki ye apps disappear ho sakte hain. RBI aur government active hain fake apps pe, lekin aapko report karna padta hai.

Final Advice

VaniCredit – Credit Easy ko avoid karo! Ye ek 7-day loan trap app lagta hai heavy charges aur fraud ke saath. Play Store ke critical reviews (jaise Sonu, Sadhna, Kiran etc.) padho – ye real experiences hain. Description pe mat jao, users ki warnings pe trust karo.

Agar emergency cash chahiye to RBI-registered apps ya banks se lo, high interest wale trap se bacho. Financially safe raho, aware raho!

Agar aapke paas is app se related personal experience hai to comment mein share karo taaki dusre aware ho sakein. Stay safe! 🚫💸