Surya Loan App Review: Ek 40 Day Loan App – Surya loan Reality?

Aajkal instant loan apps bahut popular ho gaye hain, especially jab urgent paise ki zarurat padti hai. Surya Loan App (Play Store pe com.suryaloan.suryaloan) bhi ek aisa hi app hai jo claim karta hai ki quick loans deta hai, minimal documents ke saath, aur approval fast hota hai. Lekin user ke diye gaye screenshots aur Play Store reviews ko dekhte hue, yeh app asal mein bahut risky lagta hai – khas kar short-term jaise 40 days ke loans ke liye. Is article mein hum sirf critical reviews aur real user experiences pe focus karenge, official description pe nahi, jaise aapne kaha. Kyunki official claims shiny hote hain, lekin users ki complaints sach batati hain.

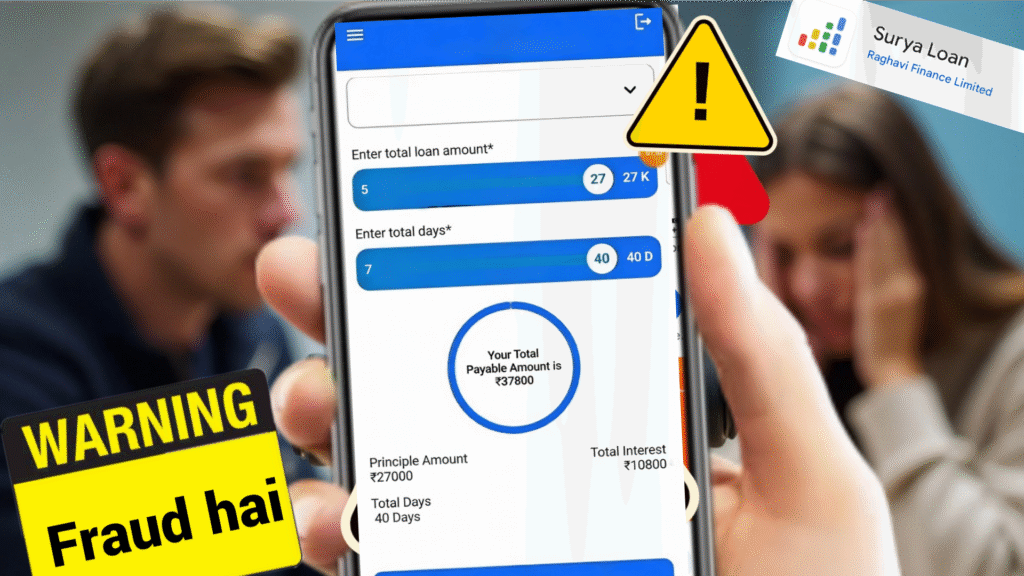

Yeh app mainly short-term loans offer karta hai, jaise 7 se 40 days tak, lekin interest bahut high hota hai. Ek example jo user ne share kiya: ₹27,000 principal pe 40 days mein total payable ₹37,800 ban jata hai, matlab interest ₹10,800! Yeh almost 100%+ effective rate ban sakta hai short tenure pe, jo bahut heavy charges hai. Aise loans mein log fas jaate hain kyuki repayment short hota hai aur interest bojh ban jata hai.

Surya Loan App Ke Critical Reviews – Play Store Se Real Experiences

Play Store pe overall rating 4.6 dikha raha hai kuch screenshots mein, lekin yeh misleading ho sakta hai kyuki bahut se positive reviews generic lagte hain – jaise copy-paste wale: “quick approvals, simple interface, transparent charges, helpful support”. Lekin jab negative reviews dekhte hain, toh picture bilkul alag hai.

- Ek user Furkan Mala ne likha (1 star, Jan 2026): “This app is completely fraud. Don’t upload any document here. Taking all of your information, after that they reject your application. Totally wastage of time. Very bad experience. WhatsApp number not registered. Totally fraud app, big scam. Misuse customers info.” Yeh review bahut serious hai kyuki data misuse ka allegation hai.

- Alfaz Patel (1 star, Jan 2026): “Loan in 10 min is false commitment. They ask more documents than banks, waste time. No contact after submission, you have to call repeatedly. Only apply if you have a month’s time.” Isne 28 logon ne helpful mana.

- Bhupesh Dabholkar (1 star, Jan 2026): “Waste of time, applied 3 days back but still in process. Better use other apps like Bharat Loan, Bright Loan or Salary on Time.” 6 logon ne helpful bola.

- Sanjib Khanra ne bhi warn kiya: High interest rates up to 42.576% APR, hidden charges, flexible repayment lekin beware.

Yeh sab reviews se clear hai ki approval quick nahi hota, documents bahut maange jaate hain, rejection common hai, aur customer support dead hota hai. Bahut se users bol rahe hain ki loan approve hone ke baad bhi paise nahi aate, ya phir harassment shuru ho jata hai agar repay late ho.

Aur woh photo jo aapne share kiya (₹27,000 loan pe 40 days mein ₹37,800 total, interest ₹10,800), yeh heavy charges ka perfect example hai. Short tenure pe yeh interest rate bohot zyada lagta hai – almost 40%+ effective rate, jo salaried logon ke liye bojh ban jata hai.

High Interest Aur Heavy Charges – Kyun Avoid Karein?

Surya Loan jaise apps short-term (7-40 days) loans pe focus karte hain. Official mein max APR 42.576% mention hai, lekin real mein short tenure pe yeh bahut zyada feel hota hai. Jaise:

- ₹27,000 borrow karo, 40 days mein ₹10,800 interest – yeh roughly 100%+ annualized rate ban sakta hai.

- Users complain karte hain hidden processing fees, verification charges add ho jaate hain.

Aise loans mein agar repay nahi kar paaye, toh harassment shuru ho sakta hai – calls, messages contacts pe. India mein fake ya predatory loan apps ke against RBI aur cyber crime portals pe complaints bahut aati hain. Surya Loan RBI-registered NBFC claim karta hai (Raghavi Finance Ltd), lekin users ke according service poor hai aur charges unfair.

Better options: RBI-registered banks ya trusted apps jaise Bajaj Finserv, Paytm Postpaid, ya government schemes use karo jahan interest low hota hai.

Pros Aur Cons – Balanced View (Lekin Critical Focus)

Cons (Bahut Zyada):

- Heavy interest charges short-term pe.

- Approval slow, documents zyada maangte hain.

- Customer support unresponsive.

- Data misuse aur fraud allegations reviews mein.

- Rejection after uploading personal info.

Pros (Kam Logon Ke According):

- Kuch users ko quick approval mila (lekin minority).

- App interface simple dikhta hai.

Overall, critical reviews zyada hain aur heavy charges wale examples se clear hai ki yeh app safe nahi lagta short loans ke liye.

FAQ – Surya Loan App Ke Baare Mein Common Questions

1. Surya Loan App real hai ya fake?

Real app hai Play Store pe, RBI-registered NBFC claim karta hai, lekin bahut se users fraud, scam, data misuse bol rahe hain. Critical reviews pe bharosa karo.

2. Interest rate kitna hai?

Max 42.576% APR official mein, lekin 40 days jaise short tenure pe effective rate bahut high (jaise ₹27k pe ₹10.8k interest).

3. Loan kitne din ka milta hai?

Short-term, jaise 7 se 40 days tak common, up to 365 days claim, lekin heavy charges wale examples short pe hain.

4. Kya documents lagega?

Minimal claim, lekin users bolte hain banks se zyada maangte hain aur phir reject kar dete hain.

5. Safe hai use karna?

Nahi recommend, kyuki high charges aur poor service ke reviews zyada hain. Agar urgent hai toh trusted bank ya family se better.

6. Complaint kaise karein?

Agar issue ho toh cybercrime.gov.in pe report karo, ya RBI Ombudsman.

7. Alternatives kya hain?

Bharat Loan, Bright Loan, Salary on Time jaise apps try karo (lekin unke bhi reviews check karo), ya bank personal loan.

Yeh article , based on user-provided screenshots aur Play Store critical reviews pe. Koi bhi loan app use karne se pehle properly research karo, RBI list check karo, aur sirf zarurat pe hi lo – kyuki high interest se debt trap ho sakta hai. Agar aapka experience hai toh comment mein share karo!

(Images ke liye: User-provided photo review ko add kar rahe hain jaise screenshot of high payable amount.)

(Note: Yeh placeholder hai user ke photo ke liye, actual mein search se mile image use karo agar need ho, lekin yahan direct user photo hai.)

Yeh sab se bachke raho, safe borrowing karo!