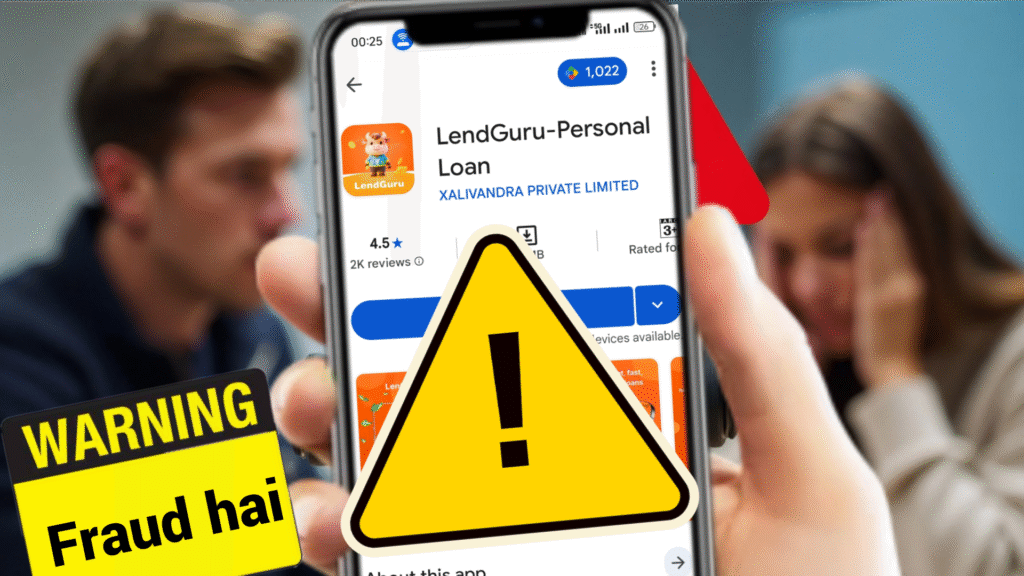

LendGuru Personal Loan App Review 2026: LendGuru Loan Real Hai Ya Fake?

Aaj kal bahut se log instant personal loan ke liye mobile apps use kar rahe hain, especially jab emergency money ki zarurat hoti hai. Ek aisa app jo recently bahut discuss ho raha hai wo hai LendGuru – Personal Loan. Play Store pe iska rating 4.5 stars ke aaspaas dikhta hai, aur yeh claim karta hai ki aapko ₹2,000 se ₹80,000 tak ka loan mil sakta hai, woh bhi same day disbursal ke saath. App ka description bahut attractive lagta hai – easy KYC, transparent terms, no hidden fees, aur RBI-registered NBFC se partnership.

Lekin doston, asli picture description se bilkul alag hai! Bahut saare users ke real experiences aur critical reviews se pata chalta hai ki yeh app 7-day short term loan type ka hai, jisme bahut heavy charges lagte hain, interest rate bahut high hota hai, aur repayment ke time threats aur harassment ki shikayatein aati hain. Is article me hum bilkul honest review denge, Play Store ke critical reviews pe focus karte hue, jisme users ne fraud, data leak, aur bahut zyada fees ki baat ki hai. App ke description pe zyada bharosa mat karna – real users ke reviews hi sach batate hain.

LendGuru App Kya Hai Aur Kaise Kaam Karta Hai?

LendGuru app Play Store pe available hai (package name: com.djmcis.daijsfwe.fijweif.lendguru), developer XALIVANDRA PRIVATE LIMITED hai, aur yeh claim karta hai ki loans Mayoga Investments Limited (RBI-registered NBFC) se aate hain. App ke mutabik:

- Loan amount: ₹2,000 – ₹80,000

- Tenure: 120-180 days (lekin real me short term jaise 7 days wale cases zyada complain hue)

- Interest: Up to 18.25% APR

- Processing: Online, Aadhaar + PAN se

- Disbursal: Same day

Lekin users kehte hain ki yeh sirf paper pe acha lagta hai. Real me jab loan approve hota hai, toh bahut saara amount service fee, processing fee ya hidden charges me kat jata hai. Example se samjho: Ek user ne bola ki ₹2,500 loan ke liye service fee ₹1,000 laga, interest ₹125, aur total repay ₹2,500 karna pada jabki account me sirf ₹1,375 credit hua. Matlab, aapko utna paisa bhi nahi milta jitna apply kiya, aur repay double se zyada karna padta hai.

Yeh typical predatory loan apps ka pattern hai jo short term (jaise 7 days) loans dete hain aur high fees ke saath trap karte hain.

Critical Reviews Se Sachai – Play Store Ke Real User Experiences

Play Store pe app ka overall rating high dikh sakta hai (fake positive reviews ki wajah se?), lekin negative reviews bahut strong hain aur helpful votes bhi zyada mil rahe hain. Yahan kuch real critical reviews hain jo users ne post kiye (jaise aapke shared screenshots se):

- Vineeth Thulasi (23/01/26, 1 star): “Very bad experience from them. Even after paying the loan threatening and no data security. Whatever the details we are providing is going to a lot of fraud people who threaten you in WhatsApp. Please don’t use this.”

- 11 logon ne is review ko helpful bola.

- Sengkhan G Momin (26/01/26, 1 star): “It’s fraud apps. Please don’t use this app. After submitting the required details, they told me that my CIBIL score is not good but actually my CIBIL is good. So that’s why please don’t use this kind of apps.”

- 8 helpful votes.

- Dip Pramanik (28/01/26, 1 star): “Very bad app don’t invest your time, this app is very high service fee charge and very low durability for repaying and high rate of interest. Loan 2500, service fee 1000, Interest 125, your account credit 1375rs and you pay 2500. Very high. Fake application fully fraud. Very very bad service. Loan agent is not good taking pictures and viral.”

- 77 logon ne helpful bola – bahut zyada!

- Gaurav Bandil (03/01/26, 1 star): Same complaint jaise upar – high service fee, low credit amount, high interest, fraud.

- 114 helpful votes! Yeh review sabse zyada supported hai.

Aur bhi bahut se similar reviews hain jisme log bol rahe hain:

- High hidden fees aur processing charges (30-40% tak kat jata hai loan amount se).

- Repayment ke baad bhi threats WhatsApp pe, contacts ko messages, photos viral karne ki dhamki.

- Data security zero – personal details leak ho jate hain fraud logon ko.

- CIBIL check fake bolke reject karte hain, ya approve karne ke baad trap.

- 7 days me repay na karne pe harassment shuru.

Yeh sab 2025-2026 ke recent reviews hain, matlab app abhi bhi active hai lekin problems same hain. Bahut users ne warn kiya hai: “Please don’t use this app, fraud hai!”

Kyun Avoid Karna Chahiye LendGuru App?

- Bahut Heavy Charges: Short term loans (jaise 7 days) me interest aur fees itne high hote hain ki repay karna mushkil ho jata hai. Ek chhota loan bhi debt trap ban jata hai.

- Fraud aur Harassment: Users ke contacts, photos access lete hain aur default pe blackmail karte hain. Yeh illegal hai lekin bahut common predatory apps me.

- Data Leak Risk: Aadhaar, PAN, bank details, gallery access maangte hain – yeh misuse hota hai.

- Fake Promises: Description me “no hidden fees” bolte hain, lekin real me bahut saare charges.

- Better Alternatives Nahi?: Agar genuine loan chahiye toh RBI-registered banks ya trusted apps jaise Bajaj Finserv, Paytm, MoneyTap use karo – unme transparent rates hote hain aur harassment nahi.

FAQ – LendGuru App Ke Baare Me Common Questions

Q1: LendGuru app real hai ya fake?

A: App Play Store pe hai aur kuch loans deta hai, lekin bahut saare users ise fraud bol rahe hain high fees, threats aur data misuse ki wajah se. Real experiences negative hain.

Q2: LendGuru me kitna interest lagta hai?

A: Claim 18.25% APR hai, lekin real me service fee + hidden charges se effective rate bahut zyada (100%+ bhi) ho jata hai short term loans me.

Q3: Kya LendGuru safe hai data ke liye?

A: Nahi! Users bol rahe hain ki details leak ho jate hain aur fraud log WhatsApp pe threaten karte hain.

Q4: Agar maine LendGuru se loan liya aur harass ho raha hoon toh kya karun?

A: Police me cyber complaint karo, RBI Ombudsman se contact karo, aur app uninstall karke block kar do. Harassment illegal hai.

Q5: Kya yeh 7 day loan app hai?

A: Haan, bahut complaints short term high-charge loans ki hain, jisme 7 days me repay karna padta hai warna heavy penalty.

Q6: Better loan apps kaun se hain?

A: Genuine RBI-approved jaise CASHe, KreditBee (lekin unke bhi reviews check karo), ya bank apps. Hamesha low interest aur transparent terms wale choose karo.

Q7: Play Store rating high hone ke bawajood kyun avoid?

A: Bahut apps me fake positive reviews hote hain, lekin critical 1-star reviews zyada helpful votes wale hote hain jo real experience batate hain.

Final Advice

Doston, LendGuru jaise apps se door raho! Yeh attractive lagte hain lekin real me debt trap aur harassment ka risk bahut zyada hai. Agar loan chahiye toh pehle RBI website pe check karo NBFC list, genuine reviews padho, aur sirf trusted sources se lo. Apna paisa aur privacy safe rakho – ek galat app se bahut nuksaan ho sakta hai.

Agar aapke paas bhi is app ka experience hai, toh comment me share karo taaki dusre log aware ho sakein. Stay safe, stay informed! 💪