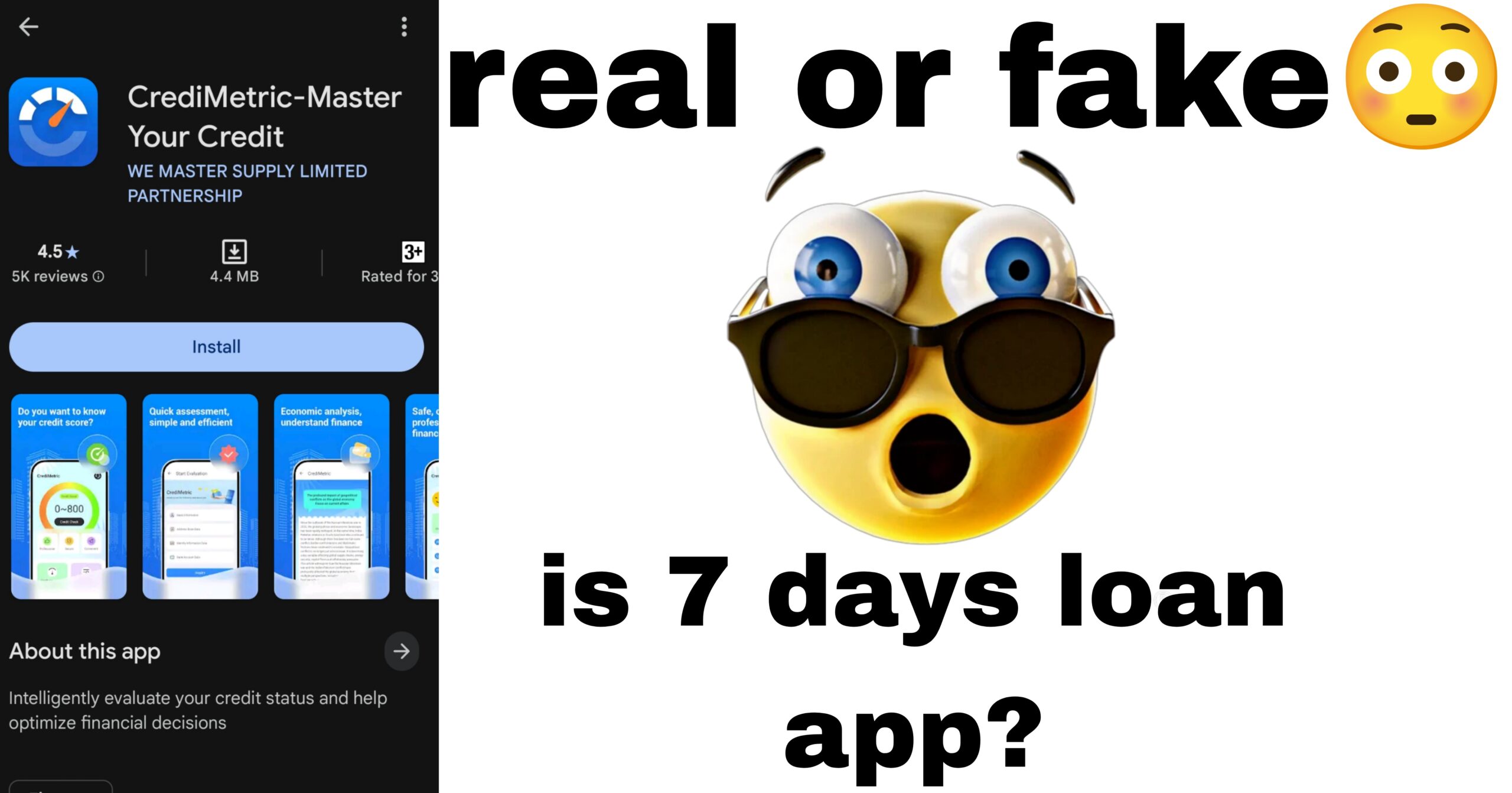

CrediMetric Loan App: Real or Fake? Credimetric loan app Reality

In today’s digital age, financial tools and apps promising quick credit score evaluations, loan approvals, and financial optimization are abundant. One such platform, CrediMetric, markets itself as a “credit scoring tool designed for individual users to help you gain a deeper understanding of your credit performance.” It claims to offer fast, accurate credit scoring, personalized financial advice, and robust data security. However, user reviews and online discussions paint a troubling picture, raising serious concerns about the app’s legitimacy. This article critically evaluates CrediMetric, analyzing its claims, user reviews, and compliance with regulatory standards like those set by the Reserve Bank of India (RBI). With over 1,000 words, we aim to expose whether CrediMetric is a genuine financial tool or a potential scam

What is CrediMetric?

According to its official description, CrediMetric is a credit scoring tool that leverages “advanced data processing technology” to analyze multi-dimensional credit data and provide users with clear, easy-to-understand credit scores and detailed reports. It positions itself as a trusted assistant for both credit novices and those looking to optimize their credit records. The app claims to offer the following key features:

- Credit Score Query: Real-time access to your current credit score and trends.

- Credit Details Report: Key insights into financial reports.

- Personalized Credit Optimization Suggestions: Tailored strategies to improve credit status.

- Data Security: Multiple encryption technologies to protect user information.

- Professional Customer Support: Assistance via email and during specified working hours.

CrediMetric emphasizes that it is an independent third-party platform, not affiliated with any financial institution, and does not intervene in transactions or disputes. Its parent company, WE MASTER SUPPLY LIMITED PARTNERSHIP, is reportedly based in Renu Nakhon, Nakhon Phanom, Thailand, with a customer service email (visitor@wemastersupply.com) and operational hours from Monday to Saturday, 9:00 AM to 6:00 PM.

Despite these claims, user reviews and online feedback suggest that CrediMetric may not live up to its promises and could potentially be a fraudulent loan app. Let’s dive into the evidence.

User Reviews: A Pattern of Complaints

The user reviews for CrediMetric on platforms like the Google Play Store reveal a consistent pattern of negative experiences, with many labeling the app as a scam. Here’s a detailed breakdown of the concerns raised by users:

- High Hidden Fees and Predatory Lending Practices:

- A user named Sahil Saju reported receiving only ₹2,800 out of a ₹4,700 loan, with the remainder likely deducted as undisclosed charges. The repayment period was an unreasonably short one week, leading to regret and distrust. This suggests that CrediMetric may engage in predatory lending practices, where a significant portion of the loan is withheld as fees, a common tactic among fraudulent loan apps.

- Allegations of Fraud and Extortion:

- Dooaanque Rao warned that CrediMetric is a “totally fraud devil” app, claiming it offers small loan amounts (e.g., ₹2,000) but demands significantly higher repayments (e.g., ₹4,500). For larger loans, such as ₹100,000, users reportedly receive only ₹40,000–₹50,000 but are required to repay the full amount. This aligns with the modus operandi of illegal loan apps, which lure users with promises of quick cash but impose exorbitant interest rates and hidden fees that exceed RBI guidelines.

- Not RBI Registered:

- Multiple reviews, including those by Dooaanque Rao and others, explicitly state that CrediMetric is not registered with the RBI, a critical red flag in India. Legitimate lending apps must be associated with RBI-regulated Non-Banking Financial Companies (NBFCs) or banks to operate legally. The absence of RBI registration suggests that CrediMetric may be operating outside India’s financial regulatory framework, increasing the risk of fraud.

- Data Theft Concerns:

- Konala Eswar labeled CrediMetric a “fake app” and a “Chinese loan app” involved in “data chori” (data theft). This accusation is particularly concerning given the app’s claim of using “multiple encryption technologies” to protect user data. Illegal loan apps often request excessive permissions, such as access to contacts, call logs, or media files, which can be used for harassment or blackmail.

- General Scam Allegations:

- Suman Saurabh Nanda called CrediMetric a “fake and scam app” and urged its removal from the Play Store. This sentiment is echoed across multiple reviews, with users warning others to avoid the app due to its deceptive practices.

Despite these negative reviews, CrediMetric maintains a surprisingly high 4.5-star rating on the Play Store, which raises suspicions of manipulated or fake reviews. Many fraudulent apps artificially inflate their ratings by posting positive reviews, often from non-Indian accounts, as Dooaanque Rao pointed out, noting that many reviewers appear to be from Pakistan or other countries.

CrediMetric’s Claims vs. Reality

Let’s evaluate CrediMetric’s claims against the backdrop of user reviews and regulatory standards:

- Fast and Accurate Credit Scoring System:

- CrediMetric claims to provide real-time, accurate credit scores. However, there’s no evidence in the reviews or online discussions to confirm that the app delivers reliable credit scoring. Instead, users focus on its loan offerings, which appear to be the primary function, suggesting that the credit scoring feature may be a facade to lure users into applying for loans.

- Exclusive Credit Optimization Guide:

- The app promises personalized strategies to improve credit status, but no user reviews mention receiving such guidance. Instead, complaints center on loan-related issues, indicating that this feature may be exaggerated or non-existent.

- Complete Data Security and Privacy Protection:

- CrediMetric’s claim of robust data security is directly contradicted by user accusations of data theft. Illegal loan apps often misuse personal information, such as Aadhaar or PAN details, for unauthorized transactions or harassment. The app’s Thailand-based parent company further raises concerns, as it may not be subject to Indian data protection laws.

- Professional Customer Support:

- There’s no mention in user reviews of effective customer support. Given the allegations of harassment and fraud, it’s unlikely that CrediMetric provides responsive or professional assistance. The provided email (visitor@wemastersupply.com) and limited working hours further limit accessibility.

- Independence from Financial Institutions:

- While CrediMetric claims to be an independent platform, its loan offerings suggest it operates as a lending app, which requires RBI registration in India. The lack of transparency about its regulatory status and partnerships with NBFCs or banks is a major concern.

Is CrediMetric RBI Registered?

One of the most critical factors in determining the legitimacy of a financial app in India is its registration with the RBI. The RBI regulates all lending operations, and legitimate apps must be backed by RBI-registered NBFCs or banks. According to user reviews and available information, CrediMetric is not RBI registered, a claim that aligns with the broader issue of illegal loan apps in India.

The RBI has been actively addressing the rise of fraudulent loan apps, with over 600 illegal apps identified in 2023 alone. These apps often operate outside regulatory oversight, charge excessive interest rates, and engage in predatory practices like data theft and harassment. The RBI has proposed creating a repository of legitimate digital lending apps to help consumers identify unauthorized platforms, but no such list currently exists.

CrediMetric’s Thailand-based parent company, WE MASTER SUPPLY LIMITED PARTNERSHIP, further complicates its regulatory status. Many illegal loan apps, particularly those with ties to foreign entities (e.g., Chinese loan apps), operate outside India’s jurisdiction, making it difficult for authorities to take action.

Red Flags of a Fake Loan App

Based on RBI guidelines and expert insights, here are the red flags that align with CrediMetric’s operations:

- Lack of RBI Registration: CrediMetric’s failure to disclose any association with an RBI-registered NBFC or bank is a major warning sign. Legitimate apps like PhonePe or Fibe clearly state their regulatory affiliations.

- Excessive Fees and Short Repayment Periods: User reviews highlight hidden charges and unreasonably short repayment terms (e.g., one week), which violate RBI guidelines on fair lending practices.

- Data Privacy Concerns: Allegations of data theft and excessive permissions suggest that CrediMetric may misuse personal information, a common tactic among fraudulent apps.

- Foreign Operations: The Thailand-based parent company raises questions about jurisdiction and accountability. Many illegal apps operate from abroad to evade Indian regulators.

- Harassment Tactics: While not explicitly mentioned in the provided reviews, the broader context of illegal loan apps suggests that users who fail to repay may face abusive calls or blackmail, as seen in cases like UnicashX and Kreditbe.

How to Protect Yourself from Apps Like CrediMetric

To avoid falling victim to potentially fraudulent apps like CrediMetric, follow these steps:

- Verify RBI Registration: Check the RBI’s official website (rbi.org.in) or contact the app directly to confirm its association with an RBI-registered NBFC or bank.

- Read Reviews Critically: Look for patterns in user reviews, especially complaints about hidden fees, data theft, or harassment. Be wary of apps with suspiciously high ratings despite negative feedback.

- Avoid Sharing Sensitive Information: Never provide Aadhaar, PAN, or banking details unless the app’s legitimacy is verified. Legitimate apps require minimal permissions and use secure websites (HTTPS).

- Report Suspicious Apps: If you encounter a fraudulent app, report it to the National Cyber Crime Reporting Portal (cybercrime.gov.in), the RBI’s Sachet portal (sachet.rbi.org.in), or the National Consumer Helpline (14404).

- Stick to Reputable Platforms: Use RBI-approved apps like PhonePe, Fibe, or Tata Capital, which comply with regulatory guidelines and prioritize user security.

Conclusion: Is CrediMetric Real or Fake?

Based on user reviews, lack of RBI registration, and alignment with common traits of fraudulent loan apps, CrediMetric appears to be a fake or highly questionable platform. Its claims of providing accurate credit scoring and secure data protection are undermined by allegations of predatory lending, hidden fees, data theft, and foreign operations. The app’s high Play Store rating is likely manipulated, as the negative reviews from Indian users provide a more credible picture of its operations.

While CrediMetric markets itself as a credit scoring tool, its loan offerings and lack of transparency suggest it operates as an illegal lending app, potentially exploiting financially vulnerable users. The RBI’s ongoing efforts to combat such apps highlight the need for caution, and CrediMetric’s Thailand-based parent company further raises concerns about accountability.

If you’re considering using CrediMetric, proceed with extreme caution. Verify its legitimacy through official channels, avoid sharing sensitive information, and opt for RBI-approved alternatives. To protect others, report any suspicious activity to the RBI or cybercrime authorities. In the digital lending landscape, trust and regulatory compliance are paramount—qualities that CrediMetric, based on current evidence, sorely lacks.