Loan One App Review: ₹10,000 Loan ka Pura Sach | Charges aur Reality Check

Aaj kal instant loan apps ka chalan bahut badh gaya hai. Play Store par aisi hi ek app hai Loan One. Lekin kya is app se loan lena aapke liye sahi hai? Aaj ke is article mein hum ek live example ke saath Loan One app ke interest rates, processing fees aur repayment schedule ka post-mortem karenge.

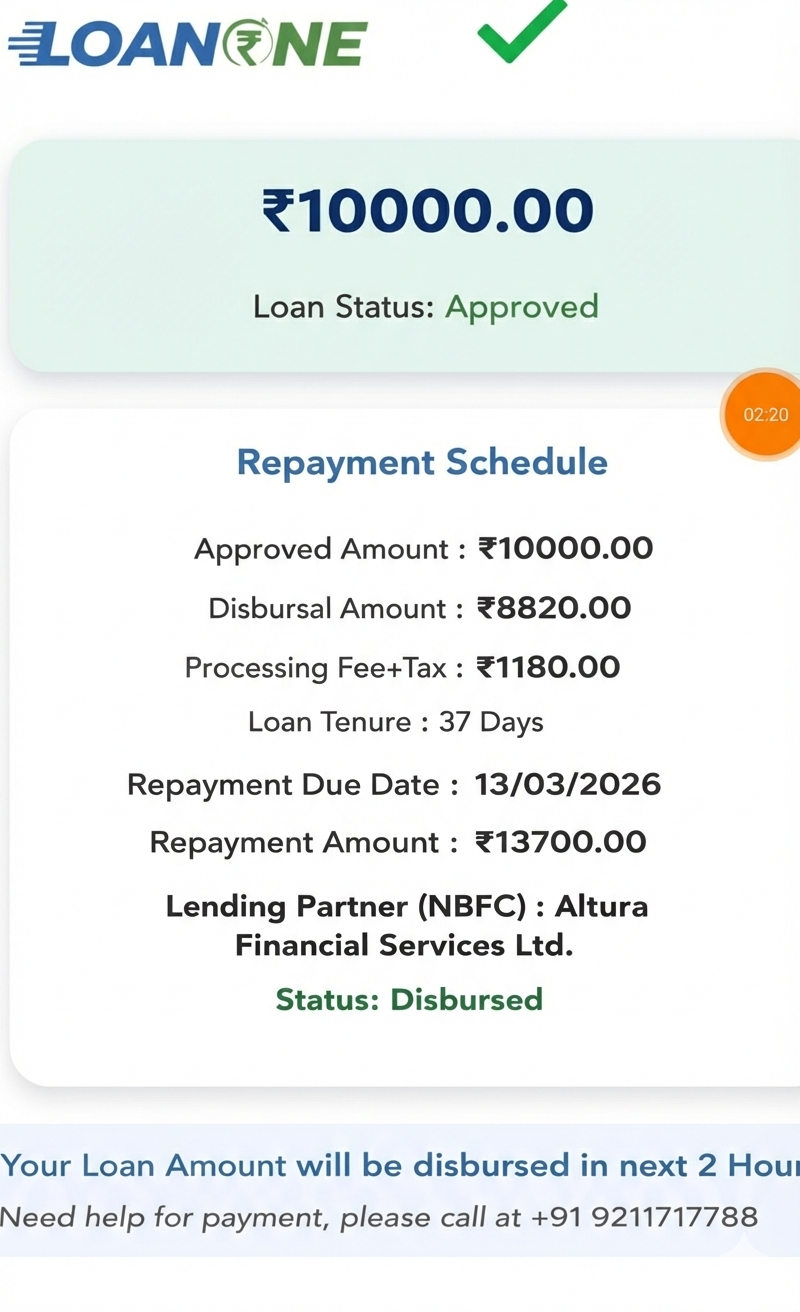

Loan One App Loan Details (Live Proof)

Humein mile ek screen proof ke mutabik, agar aap ₹10,000 ka loan apply karte hain, toh uska hisaab-kitab kuch is tarah hota hai:

| Particulars | Details |

|---|---|

| Approved Amount | ₹10,000.00 |

| Bank Account mein kitne aayenge? (Disbursal) | ₹8,820.00 |

| Processing Fee + Tax | ₹1,180.00 |

| Loan Tenure (Samay) | 37 Days |

| Total Repayment (Wapas kitna karna hai) | ₹13,700.00 |

| Interest Rate aur Charges: Ek Kadwa Sach | |

| Agar aap upar diye gaye figures ko dhayan se dekhein, toh aap hairan reh jayenge. |

- Pehli Katauti: Loan approve ₹10,000 ka hua, lekin aapke hath mein sirf ₹8,820 aaye. Matlab ₹1,180 pehle hi kat gaye.

- Bhari Repayment: Sirf 37 dino ke baad aapko ₹13,700 bharna hai.

- Asli Kharcha: Aapne istemal kiye ₹8,820 aur extra bhare ₹4,880.

Note: Sirf 1 mahine aur 1 hafte ke liye ₹4,880 extra dena bahut bada financial bojh ho sakta hai. Ye interest rate saal ke hisaab se dekha jaye toh 500% APR se bhi upar ja sakta hai.

Lending Partner (NBFC) Kaun Hai?

Image ke mutabik, Loan One ka lending partner Altura Financial Services Ltd. hai. Ye ek registered NBFC (Non-Banking Financial Company) hai. Registered NBFC hona acchi baat hai, lekin iska matlab ye nahi ki loan sasta hai. In apps ke interest rates bank loan ke muqable 10 guna zyada ho sakte hain.

Pros aur Cons (Fayde aur Nuksan)

Pros:

- Instant approval aur fast disbursal.

- Kam documentation (Sirf PAN aur Aadhaar).

Cons:- Bahut High Interest: ₹8,820 lekar ₹13,700 dena bahut mehnga hai.

- Chota Tenure: Sirf 37 din ka samay repayment ke liye kafi kam hota hai.

- Processing Fees: ₹1,180 ki high processing fee.

Savdhan Rahe: Loan lene se pehle ye zaroor sochein- Repayment Capacity: Kya aap 37 din baad ₹13,700 ek saath de payenge? Agar nahi, toh penalty aur recovery calls aapko pareshan kar sakte hain.

- Contacts Access: Aise apps aksar aapke contacts ka access maangte hain. Permission dene se pehle privacy policy zaroor padhein.

- Emergency Only: Aise loans ko sirf tabhi lein jab koi aur raasta na bacha ho.

Final Verdict

Loan One un logon ke liye theek ho sakta hai jinhe sakht zaroorat hai aur jo bhari interest de sakte hain. Lekin ek aam user ke liye, ye loan ek karz ke jaal (Debt Trap) jaisa sabit ho sakta hai. Hum hamesha salah dete hain ki pehle doston, family ya bank se baat karein.

Disclaimer: Ye article sirf jaankari ke liye hai. Hum kisi bhi loan app ko promote nahi karte. Loan lene se pehle niyam aur shartein (T&C) dhyan se padhein.